Hiding in Plain Sight: Private Asset Exposure Through Public Equities

Investors already get private asset exposure through public stocks, as major companies invest directly and indirectly in private firms—without added liquidity o

KEY TAKEAWAYS

- Investors in public markets already have some exposure to private assets, without directly facing frictions like limited liquidity and transparency.

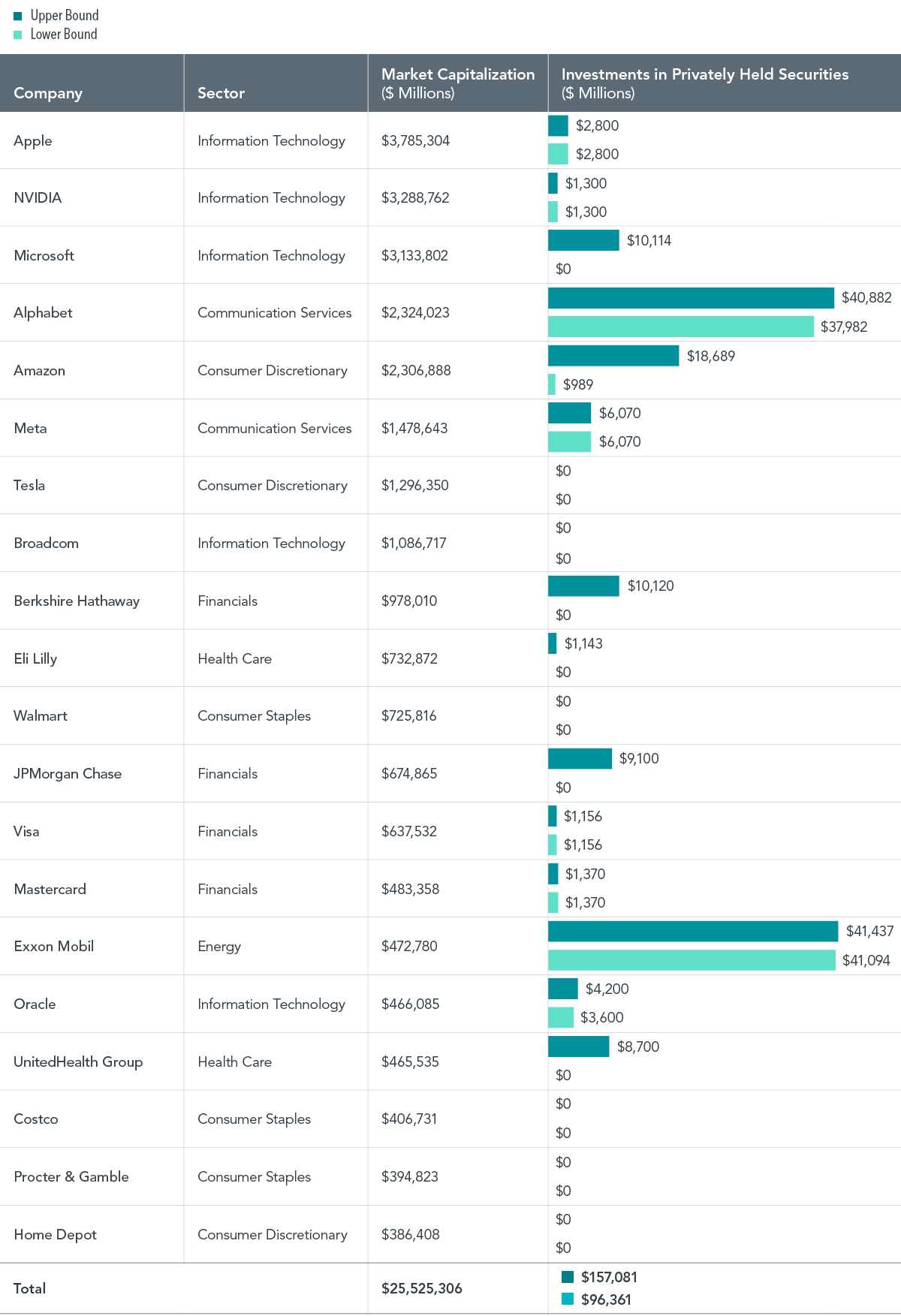

- Accounting statements indicate that the 20 largest US public companies invest about $100–$150 billion directly in private companies.

- In addition, public companies also have indirect exposure to private markets via corporate venture capital (CVC) and subsidiaries.

Investors may face hurdles to direct investing in private capital markets, including limited transparency and liquidity as well as increased complexity and costs. But most investors are already getting exposure to private assets through their public investments, even without directly facing those frictions.

The reason: Public firms invest in private ones all the time, so investing in public firms already means an allocation to private.

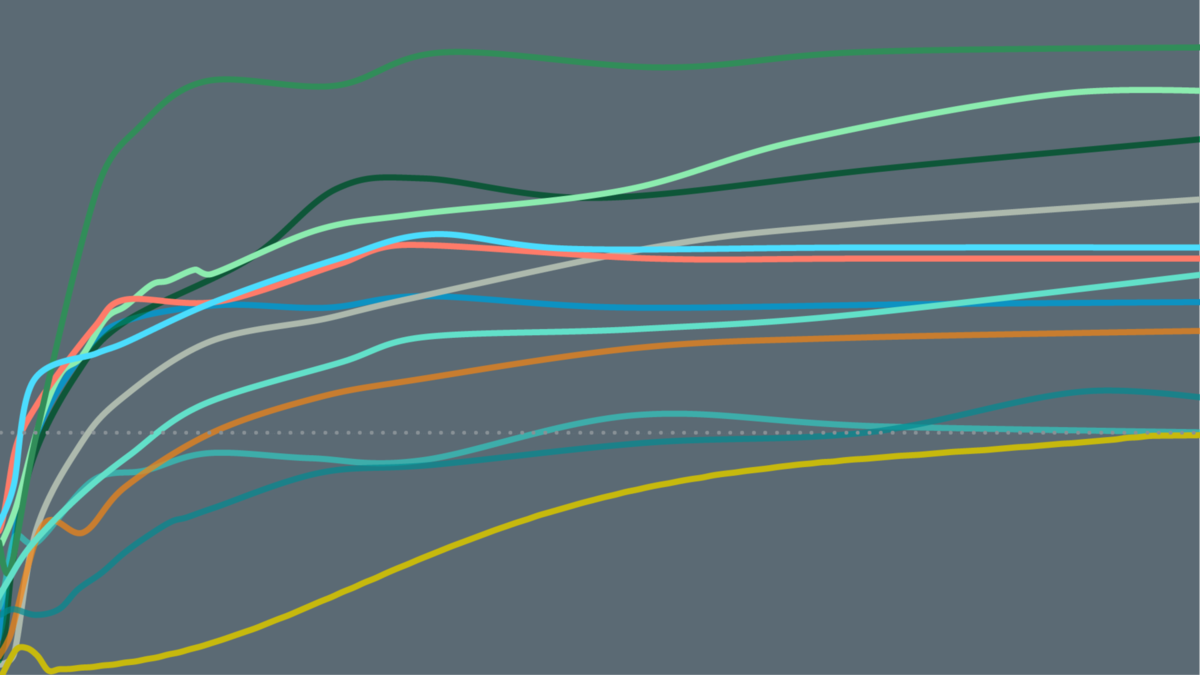

How much of an allocation? Finding a precise answer is impossible, but information from public companies’ accounting statements indicates that out of $25 trillion invested in the 20 largest US stocks, investors get about $100–$150 billion in exposure to private investments. While it is still a small number compared to the roughly $11.5 trillion invested in private equity and private debt, the exposure is meaningful and includes ownership stakes in some well-known companies.1

For example, Amazon became a minority stake holder of Anthropic, an American artificial intelligence (AI) startup known for its Claude large language model, by investing $5.3 billion as of Q4 2024. According to its financial statement, Amazon plans to invest an additional $2.7 billion by Q4 2025. Alphabet, Microsoft, and NVIDIA also have minority stakes in Anthropic.

In addition to about $100–$150 billion in direct investments, private investment by a public company could take the form of corporate venture capital (“CVC”).2 CVCs are prevalent across sectors and have a long history. For example, in 2009, Google Ventures (now “GV”) was launched as an independent venture capital (VC) firm with one limited partner: Alphabet. The private equity firm now has $10 billion in assets under management. As of December 31, 2024, Alphabet was the fourth-largest publicly traded stock in the US. By holding Alphabet, investors therefore have an indirect stake in GV and hence in a private company like Stripe, one of GV’s investments. Millions of companies use Stripe to process payments in person, online, or in apps.

By holding the top 20 US publicly traded equities, investors also have a stake in NVentures (NVIDIA’s private capital arm), M12 (formerly Microsoft Ventures, a private equity firm and subsidiary of Microsoft), Amazon Catalytic Capital (Amazon’s VC fund), and Lilly Ventures (the global biotech investment arm of Eli Lilly), among many others.

Private asset investment by public companies can take on many forms beyond direct investments and CVC. Again, take Alphabet as an example. The company invests in private firms not only through its CVC but also through its subsidiaries. In 2024, the company invested $350 million in the privately held Indian e-commerce company Flipkart through the Alphabet subsidiary Shoreline International Holdings. Even though Shoreline is a wholly owned subsidiary of Alphabet, it is a holding company and does not own or operate any Google products or services.

These investments are an important reminder that even a portfolio made up entirely of publicly listed stocks provides some exposure to private assets.

Methodology and Data Details

To estimate public companies’ exposure to private assets, we examine the latest annual financial reports (10-K) of the 20 largest US public companies as of December 31, 2024. Together these companies account for 40.6% of the US total market capitalization and represent seven out of 12 GIC sectors.

A public company is required to disclose its investments in different ways depending on the degree of its ownership stake. In general:

- An ownership stake of less than 20% of the voting stock corresponds to little or no influence over the investee, and the investment is measured at fair value at each reporting date.

- An ownership stake between 20% and 50% of the voting stock corresponds to significant influence without control, and the investment is reported under the equity method.

- If an ownership stake is greater than 50%, the acquisition is considered majority, and the financial statements of the company and subsidiary are consolidated.

We therefore examine the investments of the 20 largest companies with ownership of less than 50%.

Exxon Mobil, for example, discloses a list of equity investments in private securities, together with the corporation’s percentage ownership interest ranging from 7% to 50%. Other companies may report only the aggregate amount invested in private equity without breaking down the holdings. For a company that reports its investment in public and private securities together, we record a range with the upper estimate assuming all private and the lower estimate assuming all public.

For investments at fair value, the range can be narrowed by recognizing the three-tier hierarchy (levels 1, 2, and 3) where levels 1 and 2 use observable inputs from active markets and level 3 uses unobservable inputs (e.g., a reporting entity’s or other entity’s own data). Based on the lack of an active market, we attribute fair value level 3 measurement as only a potential investment in private securities.

To broaden the scope of investment in private companies, we also examine equity warrants, other equity securities, and convertible debt. For example, Amazon disclosed $13.8 billion in convertible notes offered by Anthropic in its 2024 annual financial statement.

Our conservative estimate is based on nonmarketable equity and debt securities, which aggregate to $96.4 billion.3 The broader estimate consists of nonmarketable equity and debt securities, equity investment reported under the fair value level 3 measurement and equity method, equity warrants, other equity securities, and convertible debt, totaling $157.1 billion.

This means private equity investments made by publicly traded equities represent a range of 0.8%–1.4% of the $11.5 trillion private equity and private debt market. See Exhibit 1.

EXHIBIT 1

Private Asset Exposure of 20 Largest US Publicly Traded Equities

As of December 31, 2024

Footnotes

1. Estimate of private fund universe is based on Preqin data as of December 31, 2024.

2. It is important to note that while CVCs are generally included in the estimated $11.5 trillion private equity and private debt market, they are typically not captured by the estimated indirect exposure of $100–$150 billion since they are wholly owned by the parent companies and thus their financials are consolidated into the parents’ financials.

3. The lower bound of estimated private investment includes Exxon’s equity investment. We confirmed that Exxon's list of equity investments, available in Note 7 of 2024 10-K, only includes private companies.

This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional.

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

CANADA

These materials have been prepared by Dimensional Fund Advisors Canada ULC. The other Dimensional entities referenced herein are not registered resident investment fund managers or portfolio managers in Canada.

This material is not intended for Quebec residents.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise noted, any indicated total rates of return reflect the historical annual compounded total returns, including changes in share or unit value and reinvestment of all dividends or other distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.